Commercial Auto Insurance Services in Kansas City

Get the Coverage You Need with Bargain Insurance Connection

Nationwide Coverage

At Bargain Insurance Connection, our commercial auto insurance services in Kansas City provide you with nationwide coverage up to $2 million in liability, cargo insurance and general liability. Whether you need coverage for semi-trucks, box trucks, flat bed trucks, or dump trucks, we have the perfect coverage for your needs.

Federal Filings & MCS-90 Filings Available

We understand that every business has different insurance needs, which is why we offer federal filings and MCS-90 filings. Our team of experienced agents will be able to assess your specific needs and tailor a policy to meet them. You can rest assured that you are in good hands with us.

Dedicated & Experienced Agents

When you choose Bargain Insurance Connection for your commercial auto insurance needs in Kansas City, you will benefit from our dedicated and experienced team of agents. Our agents understand the unique needs of businesses and are committed to providing the best service possible. We strive to make the process of obtaining and renewing your insurance policy as easy as possible.

What is Commercial Auto Insurance?

Commercial auto insurance is specifically designed to cover your autos used in connection with operation of your business. It covers autos owned by you or your business against damages like bodily injury or property damage in an accident caused by you or your employees. Commercial policy can cover your business auto with a higher liability limit, with common limit of 1 million.

Commercial insurance allows you to use your vehicle for business purposes which are not allowed under your personal auto insurance (i.e. deliveries, taxi or limo service, trucking, freight moving etc).

Your personal auto insurance will not typically provide coverage for vehicles used in operation of your business.

Is Commercial Vehicle Insurance Required?

Every Kansas City driver is required to carry auto insurance, and commercial vehicle operators are no exception. However, businesses that own or operate vehicles in any capacity must buy commercial insurance, specifically.

Business auto insurance can be instrumental in helping businesses minimize their liabilities in the face of challenges involving company vehicles. To ensure that you get the best coverage solutions for your operation, just contact Bargain Insurance Connection. We’ll be your trusted, expert agency partner that will help you get the coverage that offers comprehensive benefits that will always be affordable.

Bargain Insurance Connection provides commercial auto insurance for many different business classes. Our agency proudly represents multiple national insurance carriers that specialize in affordable but quality commercial insurance. We will discuss with you about the needs of your business, coverage that is best for your situation and try to find a good match with lowest premiums.

Our agents are trained to maximize all the discounts for which you qualify to reduce your insurance premium. We offer free and fast quotes and if you are happy with the coverage and rates, you can buy the policy over the phone and have immediate proof of insurance.

Even if you own a commercial size truck (i.e. flat bed pickup or box truck) but you only use it for personal use, we can get it insured with a non-business use commercial policy.

Contact us at 816.453.7722

Get customized coverage for your commercial vehicle:

- Motor Truck General Liability: Limits up to $2 million

- Non-Trucking Liability: Provides coverage for your truck while using it for non-business purpose.

- Motor Truck Cargo: Provides coverage for your cargo while in transit.

- Rental Coverage: Provides rental coverage during downtime.

- Trailer Interchange Coverage: Provides physical damage coverage to non-owned trailers.

Types of trucks we can insure

Box Truck:

A box truck is commonly used for deliveries (furniture and appliances), typically less than 100 miles radius, but can be insured for nationwide service. CDL license is usually not required for this type of truck.

Semi Truck / Tractor:

We can insure owner-operator or private carrier. Local or nationwide service radius is accepted. We can also provide bob-tail and non-trucking coverage. Customized coverage and flexible payments that suits all businesses.

Dump Truck:

These trucks are used for hauling dirt, sand and gravel for construction sites. Dump trucks are often used on construction sites in the cities, therefore are exposed to higher risk of an accident. We offer many different limits to satisfy your business needs.

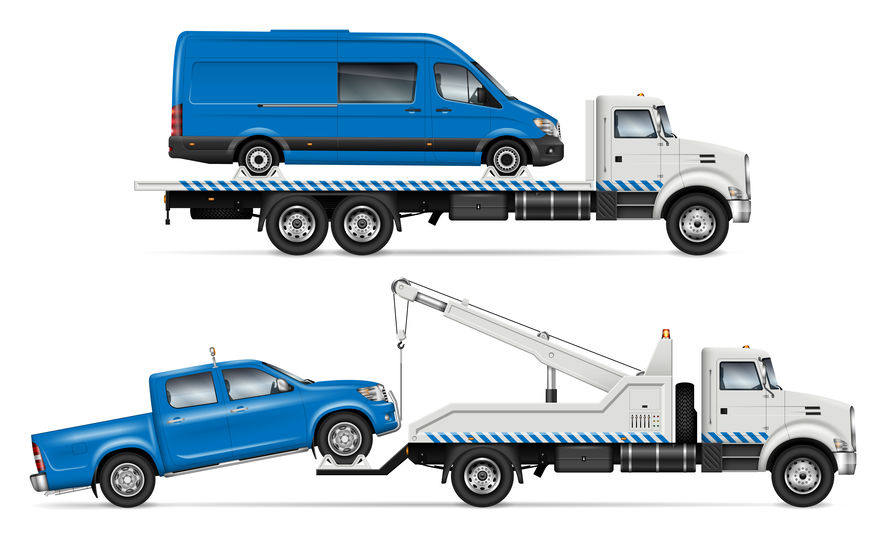

Tow Trucks:

Roll-bed or car haulers are used for towing cars locally or long distance. On-hook coverage available to cover towed vehicles against damage. Also available is garage liability to cover towed vehicles while in your custody.

Pick Up Trucks:

Pickup trucks are commonly used in construction business – carpenters, roofers, contractors and landscapers. Regular pickup bed or a flat bed is allowed. You can also combine personal and business use. You can also include physical damage for your trailer.

Cargo Vans:

Cargo vans are typically used by plumbers, electricians, HVAC service technician or carpet layers. Variety of liability limits available for every business need. Insurance coverage for your tools also available.

More About Business Vehicle Insurance:

When Do I Need Business Auto Insurance?

Anyone who owns or uses a vehicle knows two things: driving is dangerous and vehicles are expensive.

Therefore, if problems arise, those involved could face significant financial strain as they try to recover. Auto insurance is designed to help lessen this burden, so that the policyholder doesn’t face significant monetary losses all on their own.

Commercial auto insurance is designed specifically for businesses that own or operate vehicles. Personal auto insurance does not cover commercial vehicles, whereas a commercial auto policy specifically addresses the business’s cost risks that they have invested in vehicle operations.

What Kind of Vehicles Can Be Covered by Business Auto Insurance?

Numerous vehicles might qualify for commercial auto insurance, including:

- Vehicles owned by a business

- Employee-owned vehicles driven for commercial purposes

- Business-owned vehicles driven by employees while they are off the clock

- Vehicles hired or rented for commercial purposes

- Certain personal vehicles that qualify as commercial due to size or weight specifications

- Keep in mind, commuting to work in your personal car does not necessitate commercial vehicle insurance.

What Does Commercial Auto Insurance Cover?

Most business auto policies offer numerous benefits, including:

- Liability Insurance: When an accident is considered your fault, this part of the policy helps pay damages to the other party:

- Bodily Injury Coverage: This part of the policy pays for medical expenses to the other party.

- Property Damage Liability Coverage: This pays for damage to the other party’s property.

- Hired/Non-Owned Auto Liability Insurance: This liability coverage extends to vehicles not owned by the business but used by them for business purposes. These might include employees’ personal cars or vehicles that you rent or hire to use temporarily. Employees are still obligated to carry personal auto insurance even if their employer has this benefit.

- Collision Insurance: This covers damage to your own vehicle that you sustained in a wreck.

- Comprehensive Insurance: This part of the policy pays for damages other than collision. Damages caused by fire, theft, vandalism or weather damage.

- Medical Payments Coverage/Personal Injury Protection: If you get hurt in an accident, this coverage can pay for your medical bills and the people in your car. Sometimes, it will cover other losses, such as lost income.

- Uninsured/underinsured Insurance: This insures you against damage caused by someone else who doesn’t have appropriate liability coverage. If you are the victim of a hit-and-run, for example, then this coverage can pay for your car’s damage.

Additionally, other policies and endorsements might help you expand your benefits, such as:

- Inland marine insurance

- Roadside assistance & rental car reimbursement

- Custom parts coverage

- Replacement cost vehicle coverage

- Gap insurance

How is Commercial Auto Insurance Calculated?

Our job is to help you get the right types and amounts of auto insurance for you. First, all Missouri drivers are required to carry at least the following coverage:

- $25,000 bodily injury coverage per person.

- $50,000 bodily injury coverage per accident.

- $25,000 property damage.

- $25,000 uninsured motorist bodily injury coverage per person.

- $50,000 uninsured motorist bodily injury coverage per accident.

Variety of factors can determine the cost of your commercial truck insurance. Your driving record, your age, type of cargo hauling, your radius of operation and number of drivers or coverage requirements. Commercial auto policies for a landscaper will be lower than a tractor-trailer hauling goods nationwide.

Additionally, if you finance your vehicle(s) then you might be required to purchase collision, comprehensive and/or gap insurance per your lender’s requirements.

It is highly recommended that you carry higher liability insurance than just the minimum coverage. The more you have, the better your business will be able to withstand the financial blow that will come from vehicle accidents.

Talk to our agents to get a quick quote on your business vehicle.

Types of discounts available to you:

- Having prior insurance, even if it is a personal auto policy.

- Possessing a CDL license can help you with the insurance rates.

- Length of driving experience

- Paying the insurance premium in full offers significant discounts.

- Multi-policy discount: Having multiple products insured with the same insurance carrier can offer you good discounts (i.e. commercial auto and general liability).

Want General Liability Insurance or Business Owners Insurance (BOP) for your business? We can cover that too!

Ready to start saving money? Request a quote below or call us.

Read More:

When Is It Time To Get a Commercial Auto Policy?

More About Missouri Commercial Auto Insurance

Commercial Truck Insurance in St. Louis, MO

Affordable Dump Truck Insurance: